|

Historic Tax Credit Act Needs Your Support!

By Amie Hayes

September/October 2021

Built in 1910, the US Grant Hotel on Broadway across from the Horton Plaza Park, is one San Diego historic site that benefitted from tax credits for its $80-million restoration project. Courtesy www.labriz.ru

Federal tax credits are a proven incentive for revitalizing historic resources and supporting economic recovery. When combined with the $50 million fund for the new California Historic Tax Credit, these credits can have a significant impact on preservation. San Diego is well-positioned to benefit from passage of the federal Historic Tax Credit Growth and Opportunity Act (HTC-GO), especially with Mayor Todd Gloria's many new housing initiatives and our plethora of Mid-Century Modern resources. Please support the HTC-GO Act now HERE.

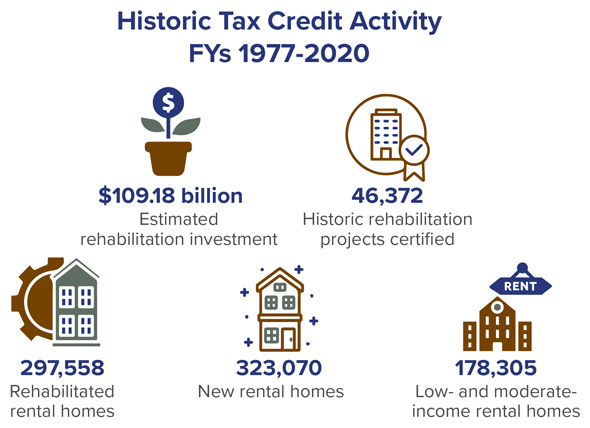

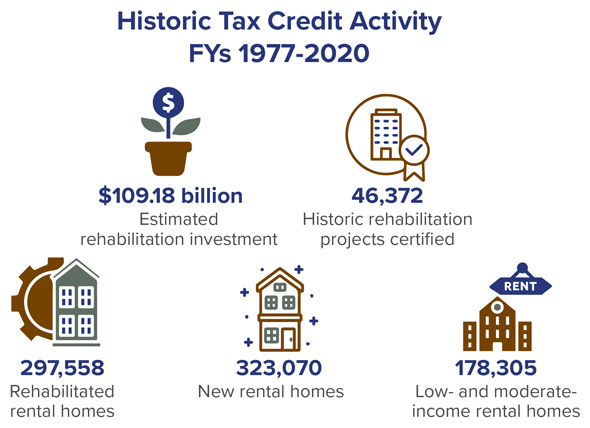

Historic Tax Credit activity, fiscal years 1977-2020. Courtesy www.novoco.com |

The HTC-GO legislation would do two main things. First, it would permanently update the Federal Historic Tax Credit (HTC) in four key areas and, second, it would provide temporary provisions, which are increased credits, for stalled projects or those impacted by the covid pandemic.

Permanent Improvements

1. Increasing the credit from 20% to 30% would enable owners and developers of smaller projects to take advantage of the program because there is more credit to sell that can be leveraged towards a rehabilitation project. However, the 10% increase is only allowed for the first $2.5 million in qualified rehabilitation expenses, which are typically the costs of the repair or improvement of the structural and architectural features, including walls, floors, windows, and doors. More information on qualified expenses can be found HERE.

2. Lowering the substantial rehabilitation threshold from 100% to 50% of the "adjusted basis" would enable more opportunity to use the credit. This threshold, called the adjusted basis, is a formula to determine if, and by how much, the rehabilitation costs exceed the pre-rehab cost of the historical resource. By lowering this threshold to 50% of the adjusted basis, smaller and more projects overall would pencil out, because the rehabilitation can be less costly, yet still applicable for the program. More information on the substantial rehabilitation formula can be found HERE.

3. The basis adjustment, or requirement to deduct the cost of the HTC from the building's property value (for tax purposes), would be eliminated, making the credits more valuable. Since this deduction would no longer be required, the purchase price for the HTC would be higher. And eliminating the basis adjustment as well as the "income recognition requirement" (Internal Revenue Code 50(d)), which enables a historic building lessee to use the credit, is consistent with the Low-Income Housing Tax Credit (LIHTC), making the combined use of these credits easier to adapt and renovate historic resources to create affordable housing.

4. Eliminating restrictions on entities with tax-exempt leasing (other than government owned buildings) would make the credit easier for nonprofits to use because they can more easily find partners to close funding gaps.

Temporary Provisions

To address projects impacted by the pandemic, either stalled or deemed no longer feasible, this provision would increase the HTC from 20% to 30% through 2024 and then gradually reduce it to 20% by 2027. Along with the pandemic, increased labor and material costs have derailed many in-progress or once feasible projects, so this additional 10% is crucial for many projects to find enough funding to get to completion.

HTC-GO paired with CA HTC

When paired with the California Historic Tax Credit (SB 451), whose application process begins in 2022, up to 50% of the qualified rehabilitation expenses could potentially be sold as credits (up to $2.5 million under HTC-GO). This percentage would increase to 55% for projects that include affordable housing, a surplus property, or are located within a transit-oriented development area or designated census track. Even further, under HTC-GO, projects could more easily fund the gap using a Low-Incoming Housing Tax Credit, which generates more credit, and could be applied to different expenses such as acquisition, to fund the project. However, while the federal program still requires the property to be income producing, the CA HTC includes a provision for owner-occupied buildings and single-family residences, providing even more opportunity for the state credit.

|

2026

2025

2024

2023

2022

2021

2020

2019

2018

2017

2016

2015

|